Market Cool On Repay Holdings Corporation's (NASDAQ:RPAY) Revenues

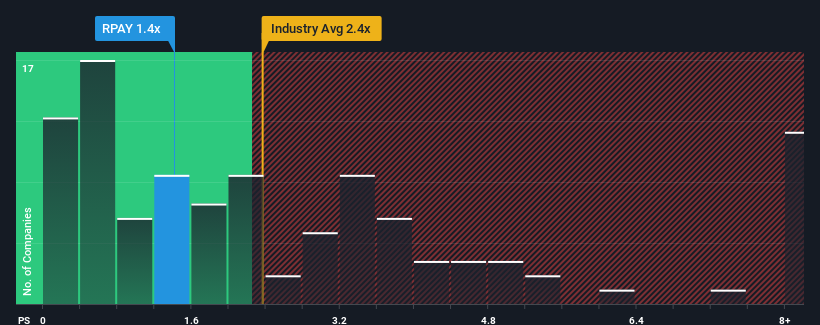

When close to half the companies operating in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") above 2.4x, you may consider Repay Holdings Corporation (NASDAQ:RPAY) as an attractive investment with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Repay Holdings

What Does Repay Holdings' P/S Mean For Shareholders?

There hasn't been much to differentiate Repay Holdings' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Repay Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Repay Holdings?

The only time you'd be truly comfortable seeing a P/S as low as Repay Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.0% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 7.3% per year growth forecast for the broader industry.

With this information, we find it odd that Repay Holdings is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Repay Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Repay Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Repay Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.