Mark Cuban Warns Of A Crisis 'Far Worse' Than 2008 If Trump's Tariff Turmoil And Elon Musk's DOGE Moves Continue

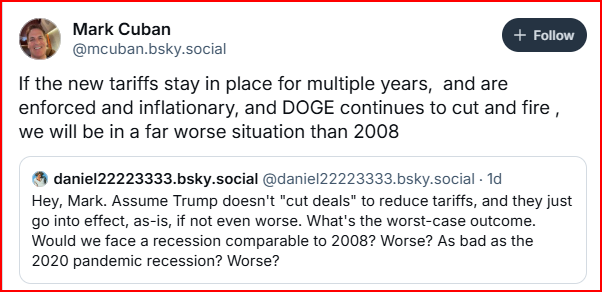

Billionaire entrepreneur Mark Cuban warns of a potential economic crisis worse than 2008 if the newly imposed tariffs persist and DOGE continues its downsizing.

What Happened: In a series of posts on BluSky Social on Sunday, Cuban outlined a grim economic forecast if the new tariffs remain in place for several years, and if DOGE continues to cut and fire. The combination of rising costs and a shrinking government workforce could cripple the economy.

When asked about the best-case scenario by another BlueSky user, he said it would involve scrapping the April 2 tariffs by Monday, keeping only a 10% levy, and Elon Musk stepping away from DOGE. If the resulting adjustments are phased in over three years with consideration for local conditions, the economy could catch a breather. The resulting slowdown might ease interest rates, making debt more manageable.

See Also: Scaramucci on Tariffs: ‘There Is Stupid and Then There Is Donald Trump Stupid’

Furthermore, the Shark Tank judge states that a narrow path to stability emerges in a "thread-the-needle" scenario. It envisions a situation where lower rates and inflation, coupled with a smaller deficit and debt, could stimulate economic growth and facilitate debt repayment. However, this scenario depends on the extension of tax cuts without any other changes.

Why It Matters: Cuban’s comments come amid a turbulent stock market caused by the newly imposed tariffs. The stock prices of major tech companies, including Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), and Amazon.com, Inc. (NASDAQ:AMZN), have taken a significant hit due to the trade war initiated by the tariffs.

While Elon Musk has advocated for a zero-tariff policy, Cuban predicts that the President’s plan will ultimately prevail in this debate. This ongoing dispute between ‘Free Trade’ Musk and ‘Full Tariff’ Trump has significant implications for the future of the economy.

Meanwhile, Goldman Sachs had warned that the U.S. Recession ‘Countdown’ has begun and raised the odds of a recession to 45% from 35%. The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NYSE:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, declined in premarket on Monday.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.