3 US Growth Stocks With High Insider Ownership To Watch

As U.S. stocks experience mixed movements amid a week focused on inflation data and interest rate expectations, investors are keenly observing the market's response to economic indicators. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 46.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

We're going to check out a few of the best picks from our screener tool.

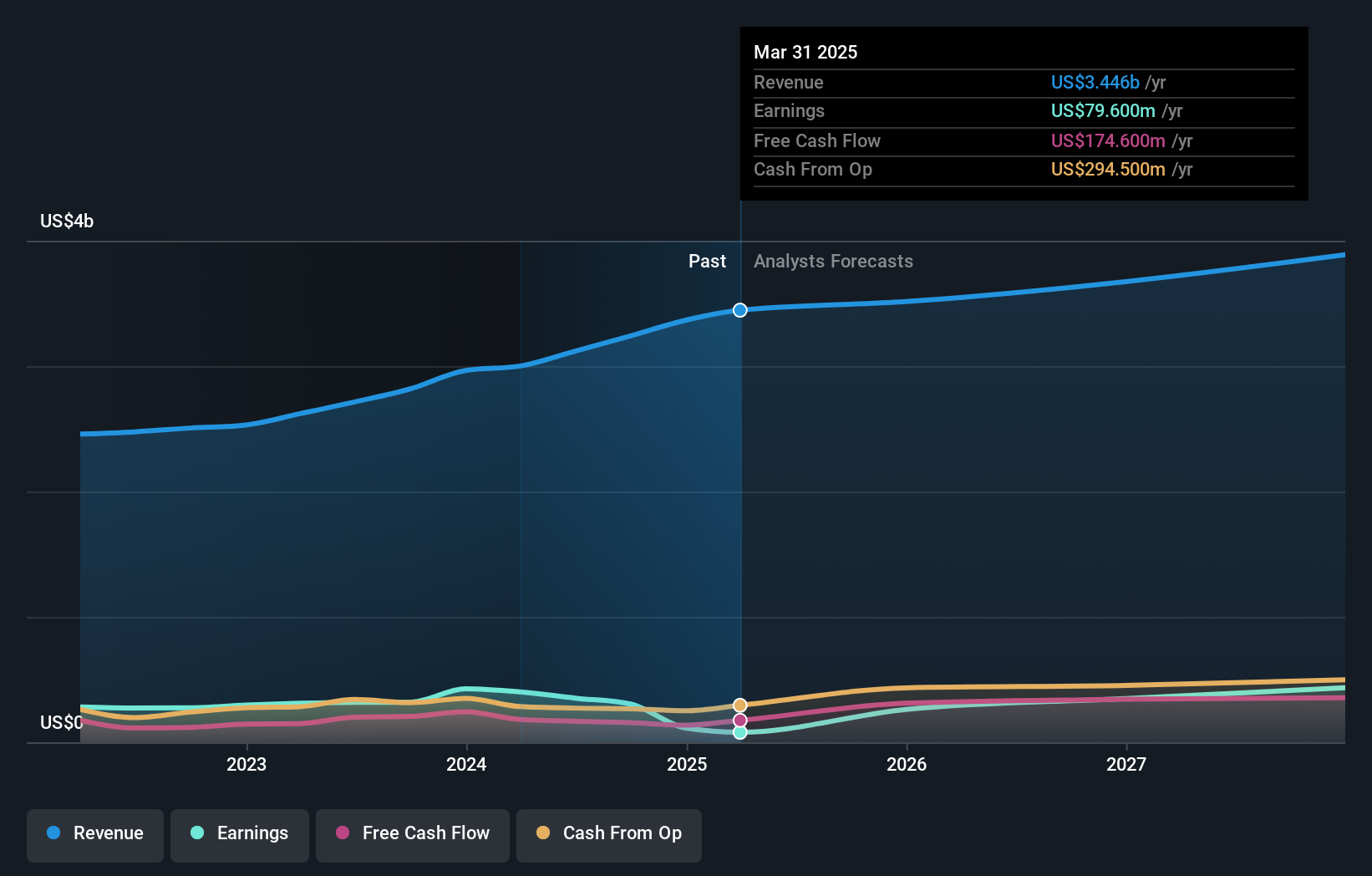

Bruker (NasdaqGS:BRKR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bruker Corporation, along with its subsidiaries, develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions globally, with a market cap of approximately $8.94 billion.

Operations: The company's revenue segments include Bruker Nano at $1.05 billion, Bruker CALID at $1.03 billion, Bruker Biospin at $891.20 million, and Bruker Energy & Supercon Technologies (BEST) at $286.10 million.

Insider Ownership: 29.0%

Bruker Corporation demonstrates strong growth potential with forecasted earnings growth of 32.3% annually, surpassing the US market average. Despite a recent dip in net income, insider confidence is reflected in substantial share purchases over the past three months. The company trades at a favorable valuation compared to peers, with a P/E ratio of 29.3x below industry averages. Recent advancements like the Dimension Nexus AFM and strategic collaborations enhance its technological edge and market positioning.

- Get an in-depth perspective on Bruker's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Bruker's share price might be too pessimistic.

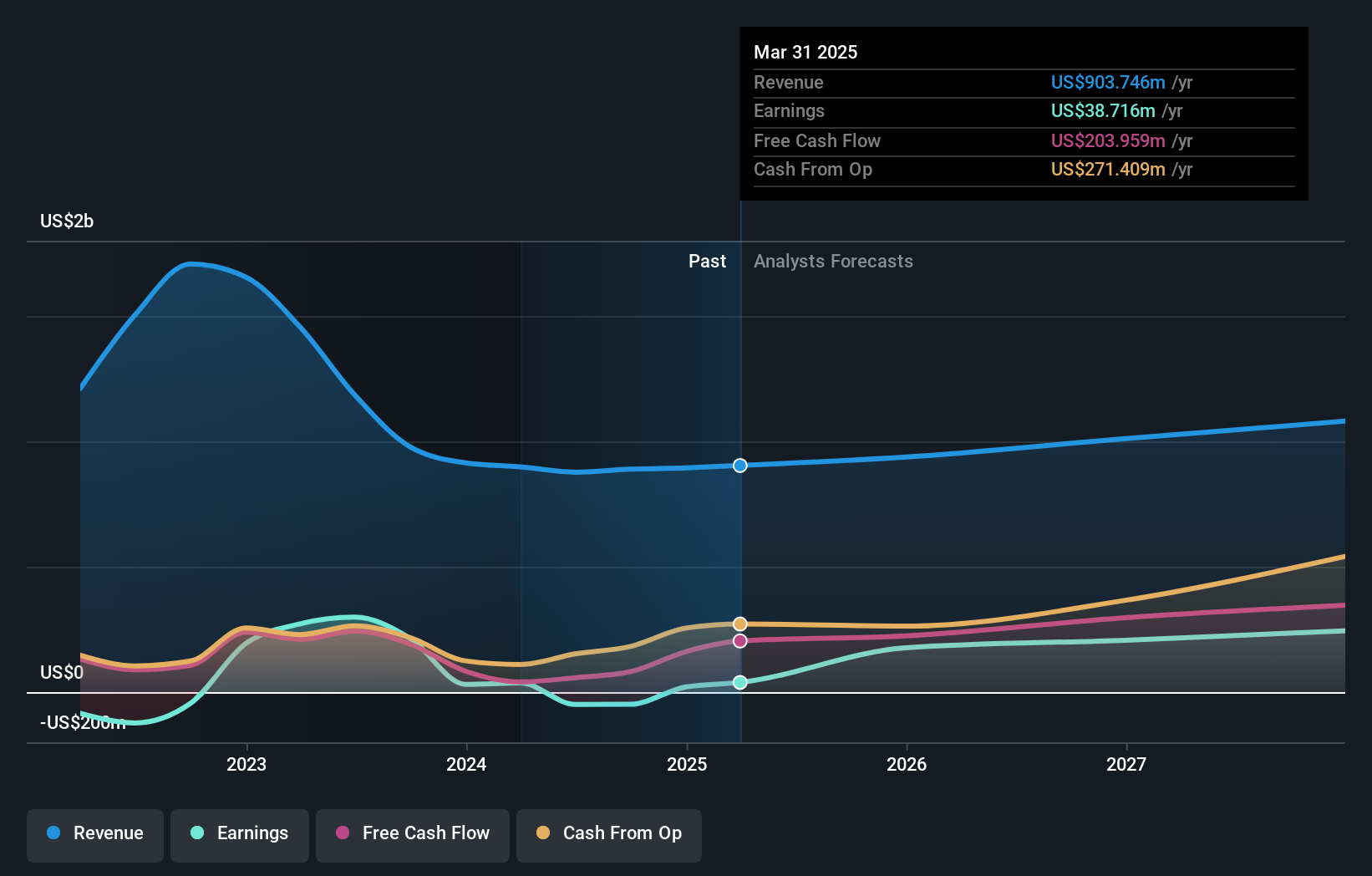

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of approximately $3.98 billion.

Operations: The company's revenue segments include $709.19 million from the U.S. Marketplace and $120.31 million from Digital Wholesale.

Insider Ownership: 17.1%

CarGurus shows potential as a growth company, with revenue forecasted to grow faster than the US market. Despite a net loss for the nine months ending September 2024, its earnings are expected to improve significantly over three years. The company's recent share repurchase plan and introduction of innovative digital retail solutions in Canada highlight strategic initiatives to enhance shareholder value and market presence. CarGurus trades significantly below estimated fair value, indicating possible undervaluation.

- Dive into the specifics of CarGurus here with our thorough growth forecast report.

- The valuation report we've compiled suggests that CarGurus' current price could be inflated.

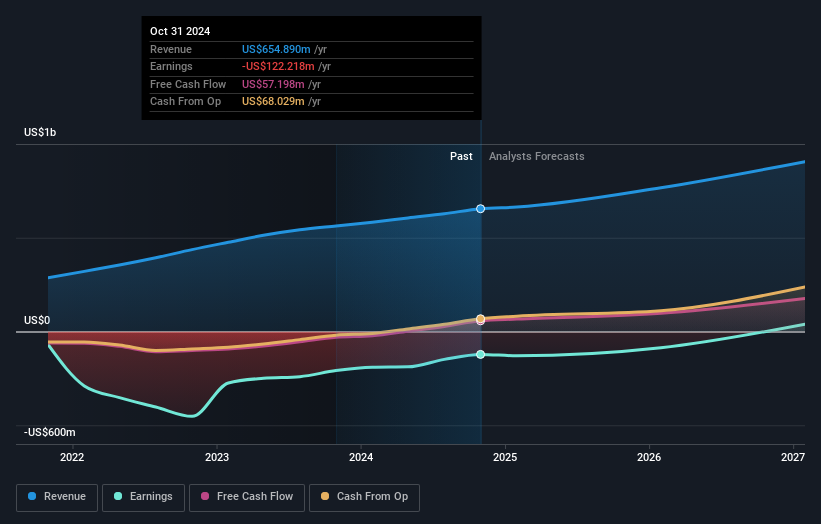

HashiCorp (NasdaqGS:HCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HashiCorp, Inc. provides multi-cloud infrastructure automation solutions globally and has a market cap of approximately $6.91 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $654.89 million.

Insider Ownership: 12.2%

HashiCorp's revenue, projected to grow at 13.6% annually, surpasses the US market's rate of 9.1%. Despite recent shareholder dilution and no substantial insider trading activity in the last three months, HashiCorp is on track to become profitable within three years with earnings growth expected at 48.7% per year. Recent earnings showed a reduced net loss of US$13.01 million for Q3 2024 compared to US$39.47 million a year ago, indicating improved financial performance.

- Navigate through the intricacies of HashiCorp with our comprehensive analyst estimates report here.

- The analysis detailed in our HashiCorp valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Click through to start exploring the rest of the 200 Fast Growing US Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com